RAMALLAH, Thursday, March 31, 2022 (WAFA) - After an extensive discussion that lasted for three days, the Council of Ministers approved late last night the draft general budget law for the fiscal year 2022 with total expected revenues of $4.771 billion and total expenditures of $5.851 billion, and expected grants from donor countries worth $523 million, including $300 million for projects and $200 million for the budget, with a deficit of $558 million.

The bill will be submitted to the President for approval to become law as of April 1, 2022.

The budget was based on the reform program by achieving a growth rate in the gross domestic product ranging between 2.5-3%, an increase in the growth rate of total public revenues by about 8%, an increase in total expenditures by 7%, and an increase in grants to $523 million compared to last year in which grants amounted to $188 million, and a 30% reduction in the deficit.

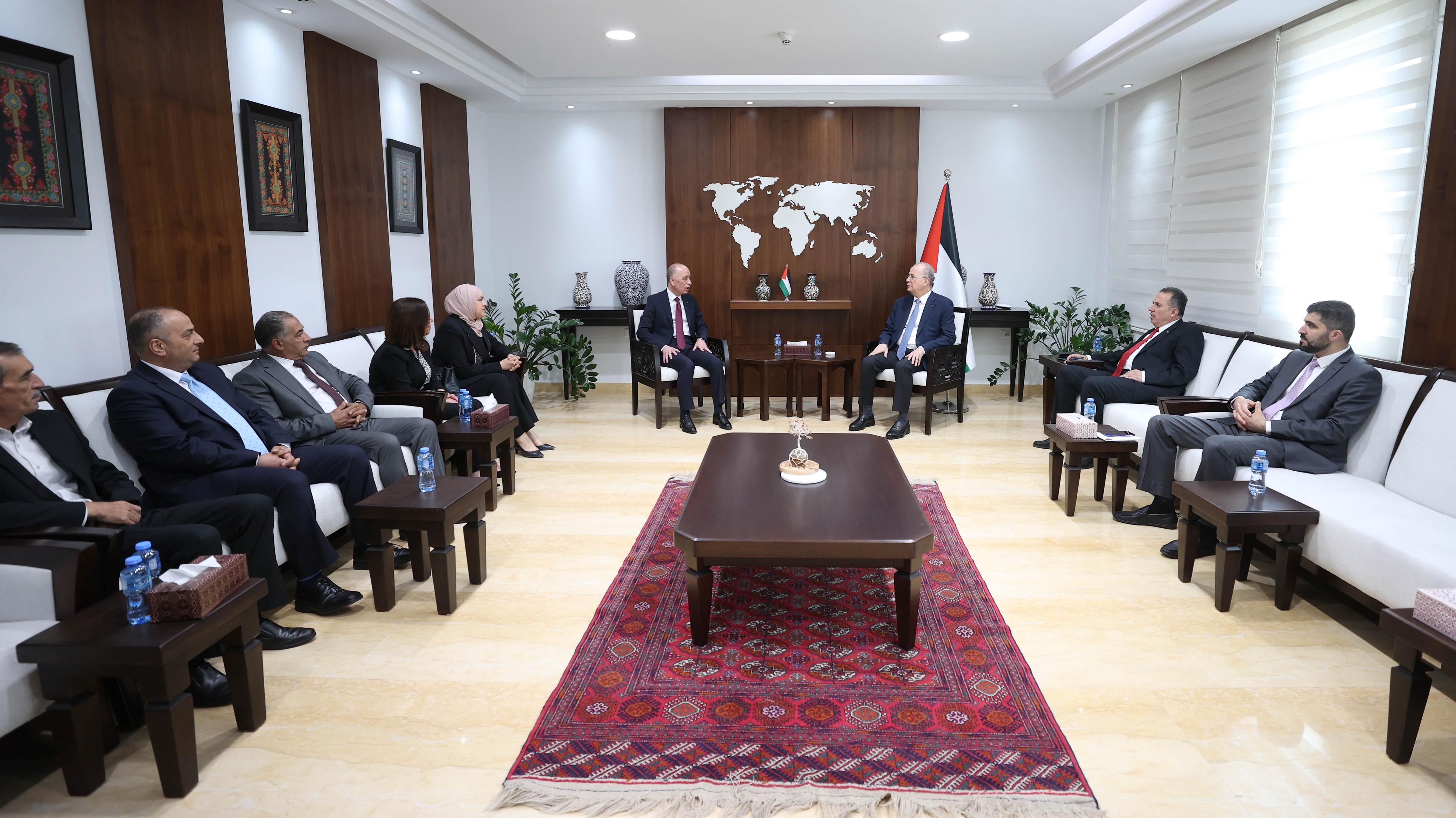

The Prime Minister stressed the importance of the mechanisms necessary to implement and adhere to the budget’s provisions, address financial imbalances in issues related to net lending and health, the reform program, combating poverty and unemployment, fulfill the government’s obligations towards Palestinians in Jerusalem and the Gaza Strip, continuing to provide services to citizens according to modern programs, and creating direct and indirect job opportunities.

The government said it will exert efforts to protect citizens from the expected global inflation due to the repercussions of the Ukrainian crisis and its political and economic repercussions, and the expected impact on Palestine in terms of the slowdown in supply chains and the resulting rise in the prices of basic commodities, such as fuel and wheat, by subsidizing the prices of basic materials and energy, and tax exemptions as much as possible, which will increase the expected budget deficit due to the loss of part of the revenue.

In light of the increasing economic and financial challenges facing the government, a number of reforms will be implemented that will improve the efficiency of public finances in a sustainable manner, through the application of the tax revenue strategy (2022-2024), ensuring the continuation of basic social services for citizens without prejudice, and controlling public debt.

The budget sets determinants aimed at strengthening the recovery process after the Corona pandemic, stimulating economic growth, combating poverty and unemployment, continuing to provide government services to citizens, and paying attention to human capital by giving importance to the sectors of education, health and social protection, and allocating development projects to enhance the resilience of citizens, especially in Jerusalem, amounting to up to $250 million and $1.9 billion for the Gaza Strip, doubling attention to Area C and to vocational training programs geared towards youth and women’s issues, combating poverty, reducing unemployment rates by increasing economic activities, expanding the base of taxpayers, confronting tax evasion, with a focus on tax justice, motivation, controlling operational expenditures, and creating about 2,800 jobs in the public sector, and increased interest in reform agenda projects and strengthening the capacity building of institutions to face any future shocks.

Important indicators appeared in the budget by focusing spending priorities on the education, health care, and social protection sectors by 54%, divided into 20% for education, 14% for health, and 20% for social protection.

At the conclusion of his presentation of the budget, the Minister of Finance expressed his optimism about an improvement in performance as a result of operational efficiency, focus on reform and the ability to overcome challenges. The Council of Ministers expressed appreciation of the effort made by the budget team to accomplish it, under the supervision of the Minister of Finance and the Undersecretary, amid volatile political and economic conditions.

M.K.